Cryptocurrency has evolved from being an obsession for a few computer geeks into a part of Reality for individuals, technophiles, and institutional investors. As the field is rapidly developing, the necessity of proper regulatory measures becomes more important than ever. Due to its status as a worldwide financial centre, the United Kingdom has been among the more forward-thinking when it comes to creating cryptocurrency measures that seek to ensure innovation does not harm the public. Here in the British isles, cryptocurrencies are still relatively new and the laws governing them are widely debated and still changing to this day, so let us explore them further in this blog post to help you keep up to date.

The Growth of Cryptocurrency

Cryptocurrency is intriguing as it may very well bring change to the way financial systems work, providing secure, reliable, fast transactions. Cryptocurrencies such as bitcoin, Ethereum, and many more types have emerged into the market with their value reaching near to the roof. But it has also lured the unlawful dealings including money laundering, frauds, and other market manipulations bringing the regulation agencies across the world into action.

The UK’s Regulatory Approach:

The United Kingdom has been active at the same time it has not been overbearing in its regulation of cryptocurrencies. Of all the regulatory bodies assigned with financial markets in the United Kingdom, the Financial Conduct Authority, also known as FCA, has been leading the provision of regulation for digital assets. The FCA’s attitude can be described more as approbation of innovation with regards to the customer interest and stability of the financial market.

Key Milestones in UK Cryptocurrency Regulations

Initial Coin Offerings (ICOs) and Security Tokens

The United Kingdom was amongst the first few countries to bring in the regulating measures categorized as Initial Coin Offerings (ICOs). In the summer of 2017, the FCA issued a consumer alert regarding ICO which qualifies it as high risk, speculative and full of fraudsters. This was succeeded by a broader proposal in 2019 where the FCA gave guidelines of some ICOs and security tokens by labeling them as securities hence falling under the securities laws.

Cryptoasset Businesses and AML Compliance

The UK recently in January 2020 has implemented very strict Anti-Money Laundering (AML) regulation requirements for cryptocurrency companies. Any business that engages in cryptocurrency operations, including exchanges, wallets, or custodians must be registered with the FCA and meet AML/CTF standards. This was in a bid to reduce vice and the Crypto market earned a more respectable reputation.

Ban on Crypto Derivatives for Retail Investors

In October last year the FCA extended its ban to include the futures and options on cryptocurrencies such as bitcoin. Such measures include, that the regulator banned trading and holding of shares due to high risk of losses, lack of reliable means of valuation and high level of market abuse. This decision has revealed that the FCA is serious about safeguarding ordinary people from the fluctuations and the nature of crypto derivatives.

Stablecoins and Central Bank Digital Currencies (CBDCs)

Stable coins still remain popular because they are linked to traditional assets such as, the US dollar and aims at bringing stability especially in the volatile market of cryptocurrencies. The government of the United Kingdom understands that stablecoins should be regulated for the maintenance of financial stability and consumers’ protection. Also, the Bank of England has recently been considering the circulation of its own digital currency known as Britcoin as the part of the CBDC program aimed at the modernization of the financial system.

The Future of Cryptocurrency Regulations in the UK

The regulatory landscape for cryptocurrencies in the UK is still evolving, with several key developments on the horizon:

- Comprehensive Legal FrameworksCurrently the UK government is developing a legislative agenda for the use of digital assets and it is believed to cover matters including; market abuse, consumer protection as well as financial stability. The set out framework is likely to offer more direction for appropriate operations for the businesses and investors; therefore, contributing to better stability within the crypto market.

- Crypto Taxation PoliciesGovernment regulation of cryptos has mainly focused on how these kinds of assets should be taxed, and different countries have come up with different solutions. In the United Kingdom, the competent authority, the HM Revenue & Customs (HMRC) has provided general advice on the taxation of cryptocurrencies with the result that the authorities class crypto assets as property for tax purposes. Over time, due to advancing in the development of the various kinds of cryptos, there should be more drastic reforms concerning the imposition of more strict and particular regulatory frameworks on taxes so as to enhance compliance as well as the promotion of equity.

- International CooperationSince the cryptocurrencies are international phenomena, international cooperation can be needed for the regulation. The United Kingdom remains a member of bodies like FATF and the G7 to set common rules in regulating Cryptocurrencies and fight international Cryptocurrency crimes.

The Impact of Cryptocurrency Regulations on the UK Market

Enhanced Market Integrity

Through strict rules and regulations, and other AML measures, the UK wants to improve the quality of the crypto market. They assist in filtering out cheaters and scammers and thus create a safer climate for investors as well as businesses.

Increased Consumer Protection

This is in line with the FCA’s attempts at imposing controls on the use of crypto derivatives as well as to uphold the standards of AML as a way of protecting the consumer on the risk associated with cryptocurrencies. These are the measures that make the operation of digital assets and related risks more widespread in the United Kingdom.

Promoting Innovation

Sometimes such regulatory measures may be perceived as negative initiatives against innovation but in the UK’s case, the country seeks to foster Innovation in the financial technology industry. Through this move of giving a clear and receptive guideline, the UK is making an effort to dominate the global market of cryptocurrencies.

Challenges and Criticisms

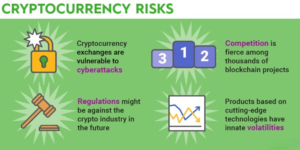

Despite the UK’s proactive stance, there are challenges and criticisms associated with its regulatory approach:

- Regulatory UncertaintyThe crypto market grows very quickly, and that fast development leads to the emergence of the new market participants and to the appearance of the new product, which is not always coherent with the latest legislation. It is imperative for the UK to remains dynamically relevant in its legal policies in order to match up to and counterbalance in the technological and other market fronts.

- Balancing Innovation and SecurityAccomplishing a balance in the creation of an innovation-friendly environment while maintaining security is quite challenging. Stringent rules can even check growth while permitting rules may open up the market for risks. Such a balance is important for the UK to sustain it competitive advantage in the global market hence requires keen attention.

- Global CoordinationSolutions should be sought on an international level, because cryptocurrencies operate beyond national borders. The UK needs to cooperate with other countries’ authorities in order to elaborate on the unified concept of regulation and to tackle the issues, which are beyond the boundaries of separate states.

Conclusion

Evidently, the current policies and legislation of the United Kingdom in regard to cryptocurrencies can be described as pro-innovative provided that the consumer interests and financial stability are granted proper consideration. Through tough measures in AML, controlling the ICOs and crypto derivatives, and evaluating the promising opportunities of stablecoin and CBDC, the country is asserting its authority as a dominant player in the sphere of crypto. Still, there are issues like uncertainty in regulation, reconciling concepts of innovation and security, and the last but not the least, the necessity of the international cooperation to unleash the full potential of cryptocurrencies.

All in all, every day a new dawn for the un-regulated market of cryptos awaits a beautiful future. The authorities of the United Kingdom can be regarded as an example of how the difficult world of digital assets should be approached, and the risks involved in this sphere balanced. Through awareness and participation of the investors, business people and the regulators, then the market for cryptocurrency in the UK and other countries can develop into a secure and prosperous market with innovation and growth.